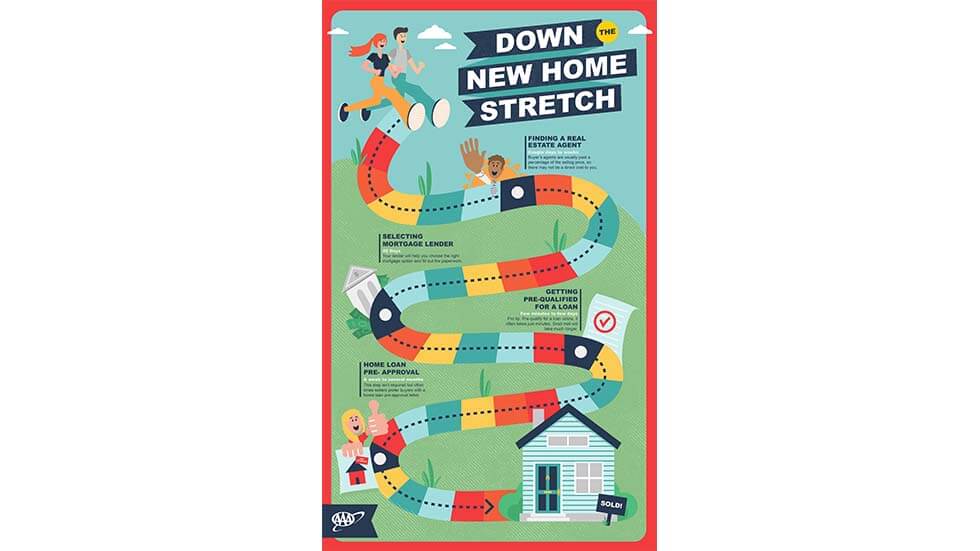

Buying a home is a big deal. Whether you’re a newbie or a veteran, the entire process can seem confusing and rather intimidating. While every path to buying a home is unique, having an idea of each step and the time it takes can make it seem a bit more bearable.

GENERAL TIMELINE

According to Zillow, it takes an average of four and a half months to buy a home from start to finish.

Keep in mind, this doesn’t include the time it may take to determine if you’re ready to buy a home, or making sure you have enough money saved for a down payment. This timeline isn’t a definite rule—certain steps can move faster or take longer than planned, altering the total time invested. Here’s a list of things you can expect in the home-buying process.

FINDING A REAL ESTATE AGENT—A COUPLE OF DAYS TO SEVERAL WEEKS

While having a real estate agent isn’t a necessity, it will definitely help you through the process, especially if you’re a first-time home buyer. Buyer’s agents are typically paid a percentage of the selling price, so there may not be a direct cost to you. You can find a real estate agent quickly, but unless you need to move into a new home immediately, don’t rush. Treat finding a real estate agent like dating, and shop around until you find an agent who understands your needs. Asking friends or colleagues for referrals is a great way to get started.

SELECTING A MORTGAGE LENDER—45 DAYS

A real estate agent helps you find your next home, but your mortgage lender is your partner in paying for it. They’ll help you choose the right mortgage option and fill out the paperwork. It’s important to select your mortgage lender in 45 days or less. Each lender you meet with will check your credit score to determine what mortgage rates you could qualify for. Normally, this many inquiries into your credit could negatively impact your credit score, but when you’re rate shopping, FICO will consider all inquiries related to a mortgage made during a 45-day period as one single inquiry, which means less of an impact on your overall credit score.

GETTING PREQUALIFIED FOR A LOAN—A FEW MINUTES TO A FEW DAYS

You can often prequalify for a mortgage loan online in a matter of minutes, but if you’d like to get a prequalification letter to produce to potential sellers, you’re at the mercy of snail mail.

HOME LOAN PRE-APPROVAL—A WEEK TO SEVERAL MONTHS

This step isn’t required, but by taking the time upfront to get pre-approved, you can reduce the timing of several other steps. By filling out most of the paperwork and going through initial credit and financial history checks on the front end of the process, the actual mortgage application process will take less time. Plus, you can save time during the offer process since you don’t have to wait to secure funding. Sellers often look for buyers to have a home loan pre-approval letter and may not accept an offer without it.